Lesson 21

Metaphors for Bitcoin's future

I know something interesting is sure to happen...

In the last couple of decades, it became apparent that technological innovation does not follow a linear trend. Whether you believe in the technological singularity or not, it is undeniable that progress is exponential in many fields. Not only that, but the rate at which technologies are being adopted is accelerating, and before you know it the bush in the local schoolyard is gone and your kids are using Snapchat instead. Exponential curves have the tendency to slap you in the face way before you see them coming.

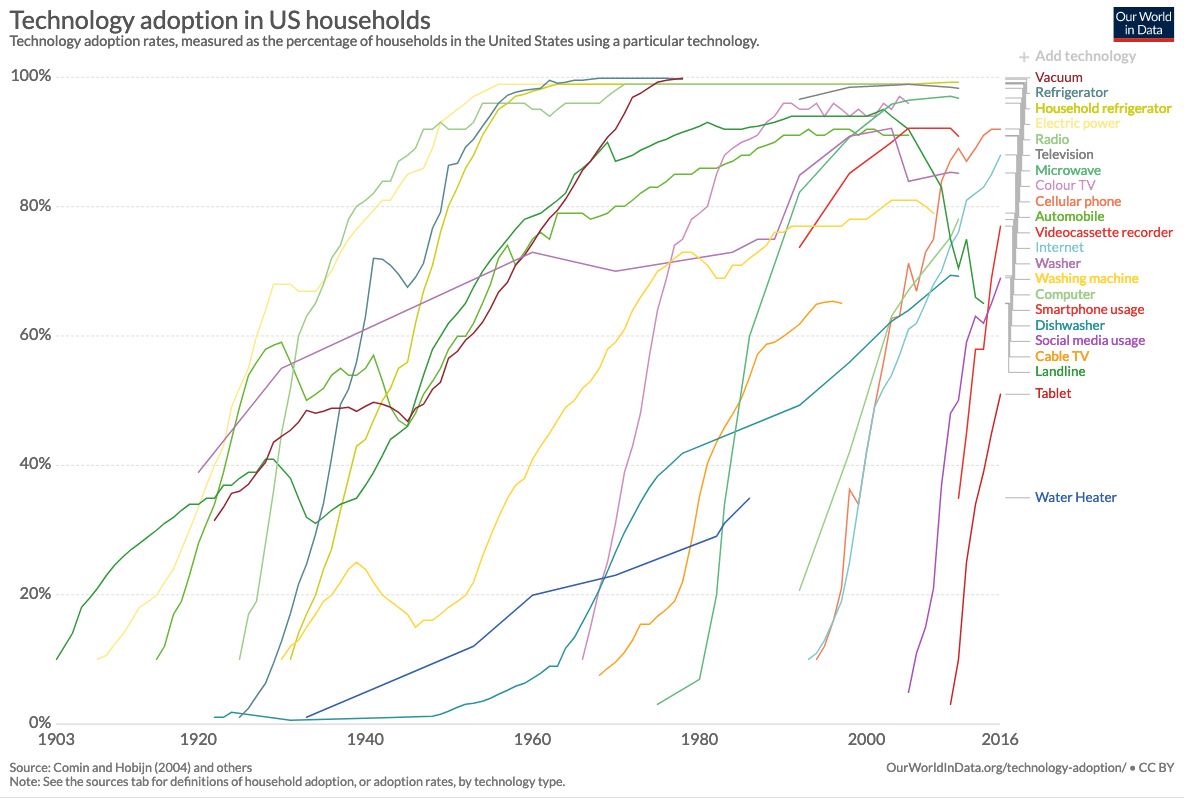

Bitcoin is an exponential technology built upon exponential technologies. Our World in Data beautifully shows the rising speed of technological adoption, starting in 1903 with the introduction of landlines. Landlines, electricity, computers, the internet, smartphones; all follow exponential trends in price-performance and adoption. Bitcoin does too.

Bitcoin has not one but multiple network effects, all of which resulting in exponential growth patterns in their respective area: price, users, security, developers, market share, and adoption as global money.

Having survived its infancy, Bitcoin is continuing to grow every day in more aspects than one. Granted, the technology has not reached maturity yet. It might be in its adolescence. But if the technology is exponential, the path from obscurity to ubiquity is short.

In his 2003 TED talk, Jeff Bezos chose to use electricity as a metaphor for the web’s future. All three phenomena — electricity, the internet, Bitcoin — are enabling technologies, networks which enable other things. They are infrastructure to be built upon, foundational in nature.

Electricity has been around for a while now. We take it for granted. The internet is quite a bit younger, but most people already take it for granted as well. Bitcoin is ten years old and has entered public consciousness during the last hype cycle. Only the earliest of adopters take it for granted. As more time passes, more and more people will recognize Bitcoin as something which simply is.

In 1994, the internet was still confusing and unintuitive. Watching this old recording of the Today Show makes it obvious that what feels natural and intuitive now actually wasn’t back then. Bitcoin is still confusing and alien to most, but just like the internet is second nature for digital natives, spending and stacking sats will be second nature to the bitcoin natives of the future.

“The future is already here — it’s just not very evenly distributed.” William Gibson

In 1995, about 15% of American adults used the internet. Historical data from the Pew Research Center shows how the internet has woven itself into all our lives. According to a consumer survey by Kaspersky Lab, 13% of respondents have used Bitcoin and its clones to pay for goods in 2018. While payments aren’t the only use-case of bitcoin, it is some indication of where we are in Internet time: in the early- to mid-90s.

In 1997, Jeff Bezos stated in a letter to shareholders that “this is Day 1 for the Internet,” recognizing the great untapped potential for the internet and, by extension, his company. Whatever day this is for Bitcoin, the vast amounts of untapped potential are clear to all but the most casual observer.

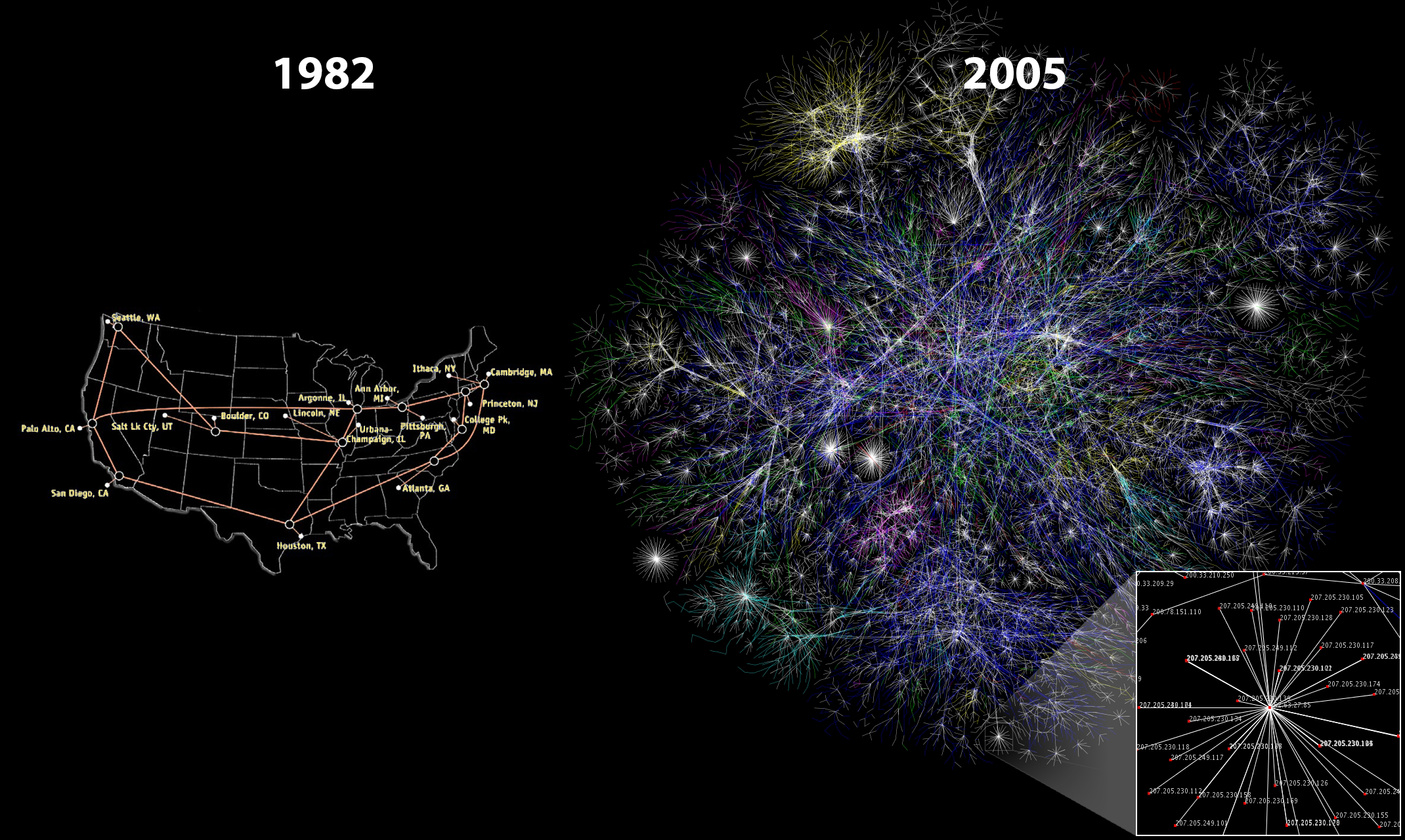

Bitcoin’s first node went online in 2009 after Satoshi mined the genesis block and released the software into the wild. His node wasn’t alone for long. Hal Finney was one of the first people to pick up on the idea and join the network. Ten years later, as of this writing, more than 75.000 nodes are running bitcoin.

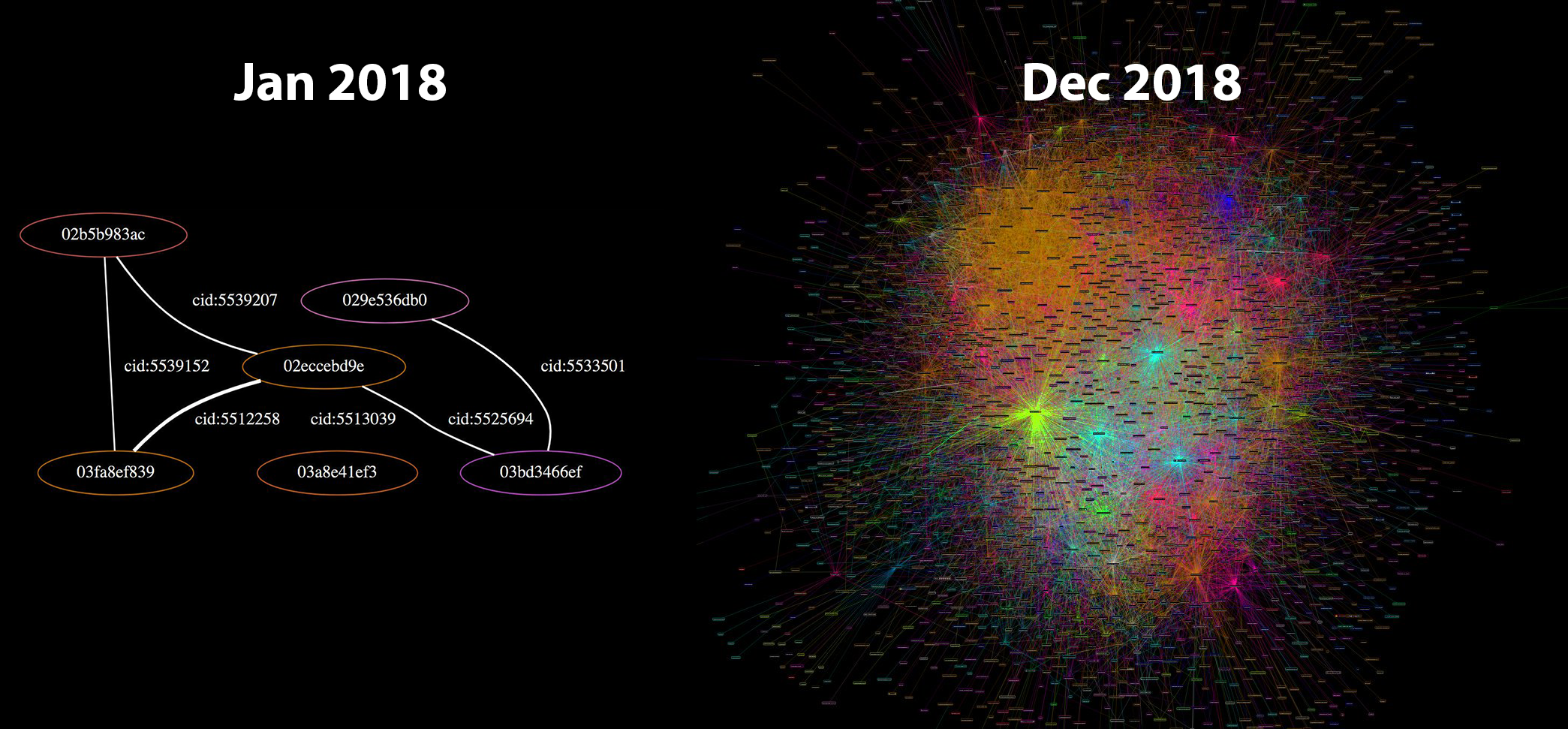

The protocol’s base layer isn’t the only thing growing exponentially. The lightning network, a second layer technology, is growing at an even faster rate.

In January 2018, the lightning network had 40 nodes and 60 channels. In April 2019, the network grew to more than 4000 nodes and around 40.000 channels. Keep in mind that this is still experimental technology where loss of funds can and does occur. Yet the trend is clear: thousands of people are reckless and eager to use it.

To me, having lived through the meteoric rise of the web, the parallels between the internet and Bitcoin are obvious. Both are networks, both are exponential technologies, and both enable new possibilities, new industries, new ways of life. Just like electricity was the best metaphor to understand where the internet is heading, the internet might be the best metaphor to understand where Bitcoin is heading. Or, in the words of Andreas Antonopoulos, Bitcoin is The Internet of Money. These metaphors are a great reminder that while history doesn’t repeat itself, it often rhymes.

Exponential technologies are hard to grasp and often underestimated. Even though I have a great interest in such technologies, I am constantly surprised by the pace of progress and innovation. Watching the Bitcoin ecosystem grow is like watching the rise of the internet in fast-forward. It is exhilarating.

My quest of trying to make sense of Bitcoin has led me down the pathways of history in more ways than one. Understanding ancient societal structures, past monies, and how communication networks evolved were all part of the journey. From the handaxe to the smartphone, technology has undoubtedly changed our world many times over. Networked technologies are especially transformational: writing, roads, electricity, the internet. All of them changed the world. Bitcoin has changed mine and will continue to change the minds and hearts of those who dare to use it.

Bitcoin taught me that understanding the past is essential to understanding its future. A future which is just beginning.

Through the Looking-Glass 🔍

Follow-up articles that expand upon ideas discussed in this lesson:

- 🔍 The World is Waking Up to Bitcoin

- 🔍 Dear Legacy People

- 🔍 Dear Bitcoiners - An optimistic letter to friends and foes around the globe

- 🔍 Dear Family, Dear Friends

- 🔍 On Bitcoin's UX

Down the Rabbit Hole

- The Electricity Metaphor for the Web’s Future by Jeff Bezos

- How the internet has woven itself into American life by Susannah Fox and Lee Rainie

- Hyperbitcoinization by Daniel Krawisz

- Speculative Attack by Pierre Rochard

- The 7 Network Effects of Bitcoin by Trace Mayer

- The Rising Speed of Technological Adoption by Jeff Desjardins

- Hyperbitcoinization - Winner Takes All by ObiWan Kenobit

- Bitcoin, Not Blockchain by Parker Lewis

- You Are Not Prepared by Knut Svanholm

- Genesis Block by Bitcoin Wiki Contributors

- Lindy Effect by Wikipedia Contributors

- Bitcoin and Technology Adoption S-Curves by Bitcoin Croesus

- 🎧 Murad Mahmudov on The Ultimate Bitcoin Argument

OTC#25 hosted by Pomp - 🎧 Bitcoin Tina on Why he is Bullish on Bitcoin

TFTC#55 hosted by Marty Bent - 🎧 Pierre Rochard on Hyperbitcoinization and Bitcoin Maximalism

HF#75 hosted by Demetri Kofinas - 🎧 Jack Mallers on how Bitcoin Disrupts Payment Clearing Houses

TIP#BTC007 hosted by Preston Pysh - 🎧 Jack Mallers on El Salvador's Bitcoin Standard

WBD#362 hosted by Peter McCormack