Lesson 14

Sound money

"The first thing I've got to do," said Alice to herself, as she wandered about in the wood, "is to grow to my right size, and the second thing is to find my way into that lovely garden. I think that will be the best plan."

The most important lesson I have learned from Bitcoin is that in the long run, hard money is superior to soft money. Hard money, also referred to as sound money, is any globally traded currency that serves as a reliable store of value.

Granted, Bitcoin is still young and volatile. Critics will say that it does not store value reliably. The volatility argument is missing the point. Volatility is to be expected. The market will take a while to figure out the just price of this new money. Also, as is often jokingly pointed out, it is grounded in an error of measurement. If you think in dollars you will fail to see that one bitcoin will always be worth one bitcoin.

“A fixed money supply, or a supply altered only in accord with objective and calculable criteria, is a necessary condition to a meaningful just price of money.” Fr. Bernard W. Dempsey, S.J.

As a quick stroll through the graveyard of forgotten currencies has shown, money which can be printed will be printed. So far, no human in history was able to resist this temptation.

Bitcoin does away with the temptation to print money in an ingenious way. Satoshi was aware of our greed and fallibility — this is why he chose something more reliable than human restraint: mathematics.

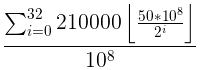

While this formula is useful to describe Bitcoin’s supply, it is actually nowhere to be found in the code. Issuance of new bitcoin is done in an algorithmically controlled fashion, by reducing the reward which is paid to miners every four years. The formula above is used to quickly sum up what is happening under the hood. What really happens can be best seen by looking at the change in block reward, the reward paid out to whoever finds a valid block, which roughly happens every 10 minutes.

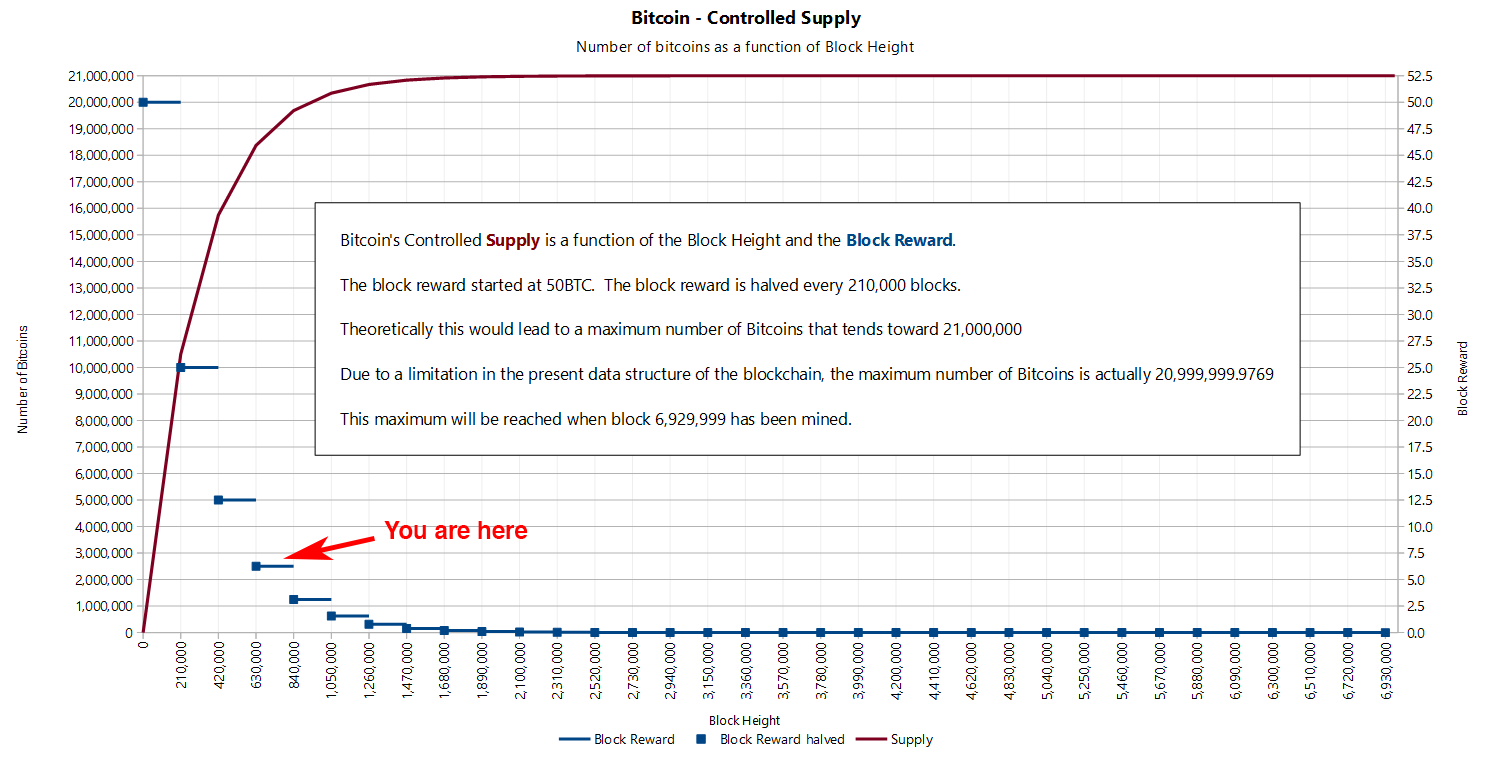

Formulas, logarithmic functions and exponentials are not exactly intuitive to understand. The concept of soundness might be easier to understand if looked at in another way. Once we know how much there is of something, and once we know how hard this something is to produce or get our hands on, we immediately understand its value. What is true for Picasso’s paintings, Elvis Presley’s guitars, and Stradivarius violins is also true for fiat currency, gold, and bitcoins.

The hardness of fiat currency depends on who is in charge of the respective printing presses. Some governments might be more willing to print large amounts of currency than others, resulting in a weaker currency. Other governments might be more restrictive in their money printing, resulting in harder currency.

Before we had fiat currencies, the soundness of money was determined by the natural properties of the stuff which we used as money. The amount of gold on earth is limited by the laws of physics. Gold is rare because supernovae and neutron star collisions are rare. The “flow” of gold is limited because extracting it is quite an effort. Being a heavy element it is mostly buried deep underground.

The abolishment of the gold standard gave way to a new reality: adding new money requires just a drop of ink. In our modern world adding a couple of zeros to the balance of a bank account requires even less effort: flipping a few bits in a bank computer is enough.

“One important aspect of this new reality is that institutions like the Fed cannot go bankrupt. They can print any amount of money that they might need for themselves at virtually zero cost.” Jörg Guido Hülsmann

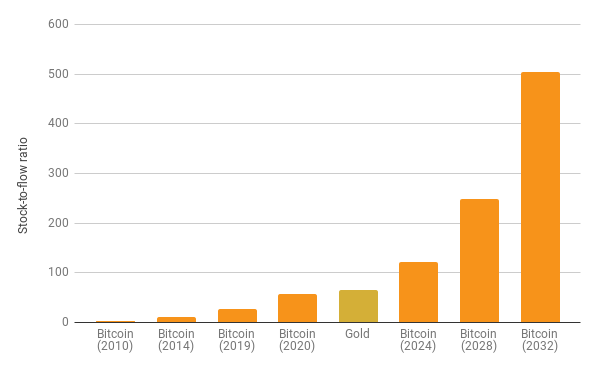

The principle outlined above can be expressed more generally as the ratio of “stock” to “flow”. Simply put, the stock is how much of something is currently there. For our purposes, the stock is a measure of the current money supply. The flow is how much there is produced over a period of time (e.g. per year). The key to understanding sound money is in understanding this stock-to-flow ratio.

Calculating the stock-to-flow ratio for fiat currency is difficult, because how much money there is depends on how you look at it. You could count only banknotes and coins (M0), add traveler checks and check deposits (M1), add saving accounts and mutual funds and some other things (M2), and even add certificates of deposit to all of that (M3). Further, how all of this is defined and measured varies from country to country and since the US Federal Reserve stopped publishing numbers for M3, we will have to make do with the M2 monetary supply. I would love to verify these numbers, but I guess we have to trust the fed for now.

Gold, one of the rarest metals on earth, has the highest stock-to-flow ratio. According to the US Geological Survey, a little more than 190,000 tons have been mined. In the last few years, around 3100 tons of gold have been mined per year.

Using these numbers, we can easily calculate the stock-to-flow ratio for gold: 190,000 tons / 3,100 tons = ~61.

Nothing has a higher stock-to-flow ratio than gold. This is why gold, up to now, was the hardest, soundest money in existence. It is often said that all the gold mined so far would fit in two olympic-sized swimming pools. According to my calculations, we would need four. So maybe this needs updating, or Olympic-sized swimming pools got smaller.

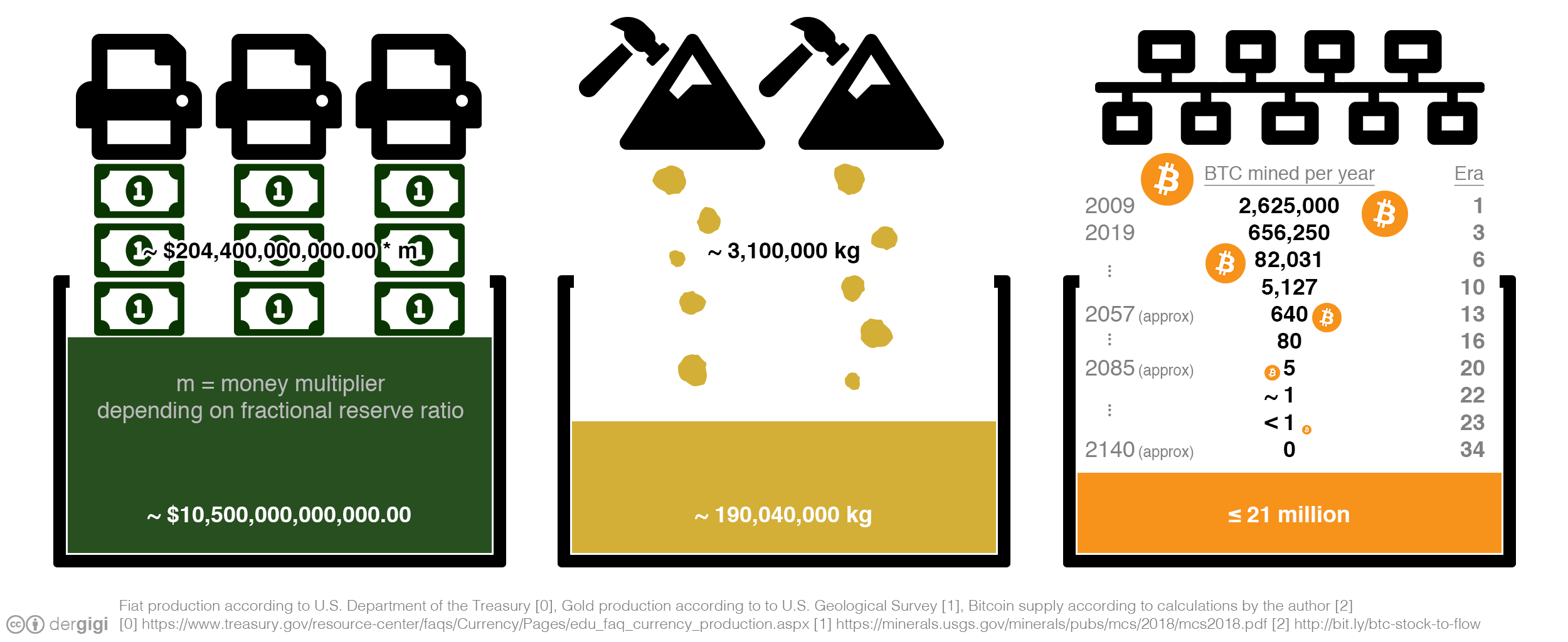

Enter Bitcoin. As you probably know, bitcoin mining was all the rage in the last couple of years. This is because we are still in the early phases of what is called the reward era, where mining nodes are rewarded with a lot of bitcoin for their computational effort. We are currently in reward era number 4, which began in 2020 and will end in early 2024, probably in May. While the bitcoin supply is predetermined, the inner workings of Bitcoin only allow for approximate dates. Nevertheless, we can predict with certainty how high Bitcoin’s stock-to-flow ratio will be. Spoiler alert: it will be high.

How high? Well, it turns out that Bitcoin will get infinitely hard.

Due to an exponential decrease of the mining reward, the flow of new bitcoin will diminish resulting in a sky-rocketing stock-to-flow ratio. It almost caught up to gold in 2020, only to surpass it four years later by doubling its soundness again. Such a doubling will occur 32 times in total. Thanks to the power of exponentials, the number of bitcoin mined per year will drop below 100 bitcoin in 50 years and below 1 bitcoin in 75 years. The global faucet which is the block reward will dry up somewhere around the year 2140, effectively stopping the production of bitcoin. This is a long game. If you are reading this, you are still early.

As bitcoin approaches infinite stock to flow ratio it will be the soundest money in existence. Infinite soundness is hard to beat.

Viewed through the lens of economics, Bitcoin’s difficulty adjustment is probably its most important component. How hard it is to mine bitcoin depends on how quickly new bitcoins are mined*. It is the dynamic adjustment of the network’s mining difficulty which enables us to predict its future supply.

(* It actually depends on how quickly valid blocks are found, but for our purposes, this is the same thing as “mining bitcoins” and will be so for the next 120 years.)

The simplicity of the difficulty adjustment algorithm might distract from its profundity, but the difficulty adjustment truly is a revolution of Einsteinian proportions. It ensures that, no matter how much or how little effort is spent on mining, Bitcoin’s controlled supply won’t be disrupted. As opposed to every other resource, no matter how much energy someone will put into mining bitcoin, the total reward will not increase.

Just like E=mc² dictates the universal speed limit in our universe, Bitcoin’s difficulty adjustment dictates the universal money limit in Bitcoin.

If it weren’t for this difficulty adjustment, all bitcoins would have been mined already. If it weren’t for this difficulty adjustment, Bitcoin probably wouldn’t have survived in its infancy. It is what secures the network in its reward era. It is what ensures a steady and fair distribution of new bitcoin. It is the thermostat which regulates Bitcoin’s monetary policy.

Einstein showed us something novel: no matter how hard you push an object, at a certain point you won’t be able to get more speed out of it. Satoshi also showed us something novel: no matter how hard you dig for this digital gold, at a certain point you won’t be able to get more bitcoin out of it. For the first time in human history, we have a monetary good which, no matter how hard you try, you won’t be able to produce more of.

Bitcoin taught me that sound money is essential.

Down the Rabbit Hole

- Bitcoin’s distribution was fair by Dan Held

- Bitcoin is Common Sense by Parker Lewis

- Bitcoin’s Controlled Supply by Bitcoin Wiki Contributors

- Mineral Commodity Summaries 2019 by the United States Geological Survey

- Money Supply by Wikipedia Contributors

- Speed of Light by Wikipedia Contributors

- 🎧 Saifedean Ammous on Bitcoin as Sound Money

Noded#3 hosted by Michael Goldstein and Pierre Rochard - 🎧 Murad Mahmudov on Bitcoin as the World Reserve Currency

TFTC#34 hosted by Marty Bent - 📚 Money, Sound And Unsound by Joseph Salerno

- 📚 The Ethics Of Money Production by Jörg Guido Hülsmann