Lesson 12

The history and downfall of money

They would not remember the simple rules their friends had given them, such as, that, if you get into the fire, it will burn you, and that, if you cut your finger very deeply with a knife, it generally bleeds, and she had never forgotten that, if you drink a bottle marked "poison," it is almost certain to disagree with you, sooner or later.

Many people think that money is backed by gold, which is locked away in big vaults, protected by thick walls. This ceased to be true many decades ago. I am not sure what I thought, since I was in much deeper trouble, having virtually no understanding of gold, paper money, or why it would need to be backed by something in the first place.

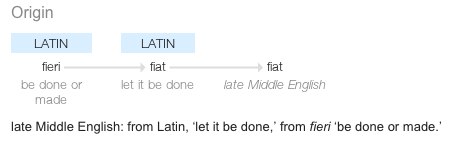

One part of learning about Bitcoin is learning about fiat money: what it means, how it came to be, and why it might not be the best idea we ever had. So, what exactly is fiat money? And how did we end up using it?

If something is imposed by fiat, it simply means that it is imposed by formal authorization or proposition. Thus, fiat money is money simply because someone says that it is money. Since all governments use fiat currency today, this someone is your government. Unfortunately, you are not free to disagree with this value proposition. You will quickly feel that this proposition is everything but non-violent. If you refuse to use this paper currency to do business and pay taxes the only people you will be able to discuss economics with will be your cellmates.

The value of fiat money does not stem from its inherent properties. How good a certain type of fiat money is, is only correlated to the political and fiscal (in)stability of those who dream it into existence. Its value is imposed by decree, arbitrarily.

Until recently, two types of money were used: commodity money, made out of precious things, and representative money, which simply represents the precious thing, mostly in writing.

We already touched on commodity money above. People used special bones, seashells, and precious metals as money. Later on, mainly coins made out of precious metals like gold and silver were used as money. The oldest coin found so far is made of a natural gold-and-silver mix and was made more than 2700 years ago. If something is new in Bitcoin, the concept of a coin is not it.

Turns out that hoarding coins, or hodling, to use today’s parlance, is almost as old as coins. The earliest coin hodler was someone who put almost a hundred of these coins in a pot and buried it in the foundations of a temple, only to be found 2500 years later. Pretty good cold storage if you ask me.

One of the downsides of using precious metal coins is that they can be clipped, effectively debasing the value of the coin. New coins can be minted from the clippings, inflating the money supply over time, devaluing every individual coin in the process. People were literally shaving off as much as they could get away with of their silver dollars. I wonder what kind of Dollar Shave Club advertisements they had back in the day.

Since governments are only cool with inflation if they are the ones doing it, efforts were made to stop this guerrilla debasement. In classic cops-and-robbers fashion, coin clippers got ever more creative with their techniques, forcing the ‘masters of the mint’ to get even more creative with their countermeasures. Isaac Newton, the world-renowned physicist of Principia Mathematica fame, used to be one of these masters. He is attributed with adding the small stripes at the side of coins which are still present today. Gone were the days of easy coin shaving.

Even with these methods of coin debasement kept in check, coins still suffer from other issues. They are bulky and not very convenient to transport, especially when large transfers of value need to happen. Showing up with a huge bag of silver dollars every time you want to buy a Mercedes isn’t very practical.

Speaking of German things: How the United States dollar got its name is another interesting story. The word “dollar” is derived from the German word Thaler, short for a Joachimsthaler. A Joachimsthaler was a coin minted in the town of Sankt Joachimsthal. Thaler is simply a shorthand for someone (or something) coming from the valley, and because Joachimsthal was the valley for silver coin production, people simply referred to these silver coins as Thaler. Thaler (German) morphed into daalders (Dutch), and finally dollars (English).

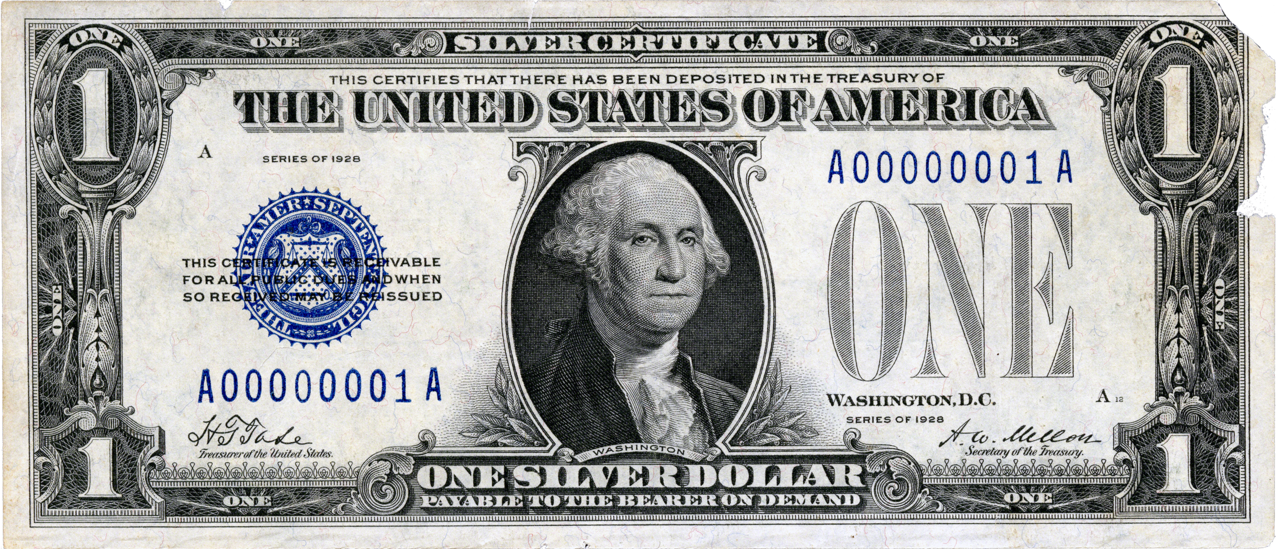

The introduction of representative money heralded the downfall of hard money. Gold certificates were introduced in 1863, and about fifteen years later, the silver dollar was also slowly but surely being replaced by a paper proxy: the silver certificate.

It took about 50 years from the introduction of the first silver certificates until these pieces of paper morphed into something that we would today recognize as one U.S. dollar.

Note that the 1928 U.S. silver dollar above still goes by the name of silver certificate, indicating that this is indeed simply a document stating that the bearer of this piece of paper is owed a piece of silver. It is interesting to see that the text which indicates this got smaller over time. The trace of “certificate” vanished completely after a while, being replaced by the reassuring statement that these are federal reserve notes.

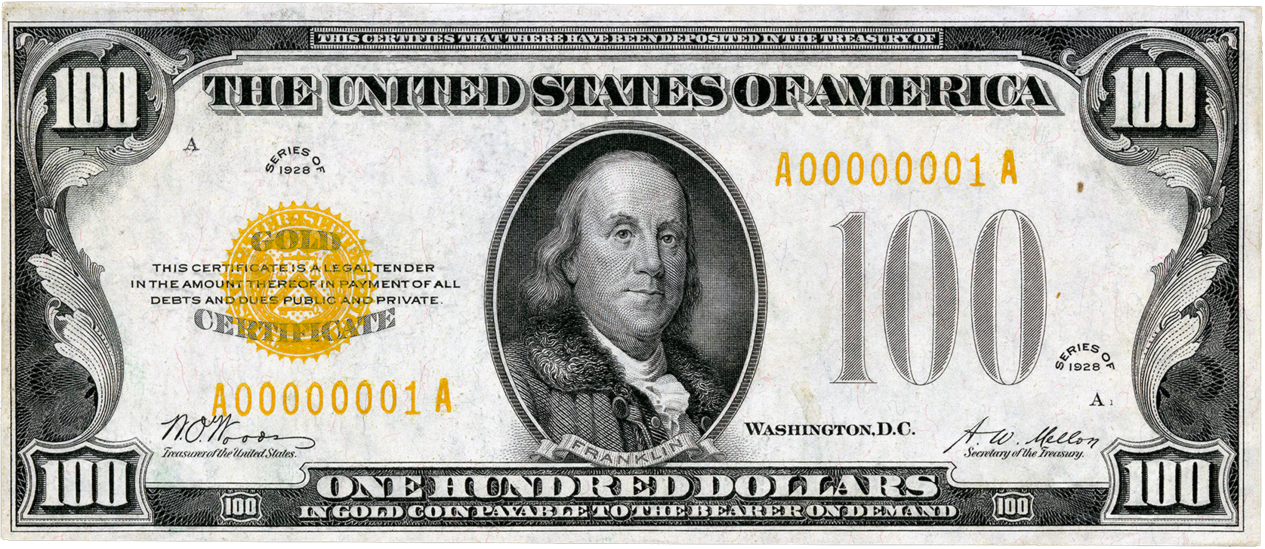

As mentioned above, the same thing happened to gold. Most of the world was on a bimetallic standard, meaning coins were made primarily of gold and silver. Having certificates for gold, redeemable in gold coins, was arguably a technological improvement. Paper is more convenient, lighter, and since it can be divided arbitrarily by simply printing a smaller number on it, it is easier to break into smaller units.

To remind the bearers (users) that these certificates were representative for actual gold and silver, they were colored accordingly and stated this clearly on the certificate itself. You can fluently read the writing from top to bottom:

“This certifies that there have been deposited in the treasury of the United States of America one hundred dollars in gold coin payable to the bearer on demand.”

In 1963, the words “PAYABLE TO THE BEARER ON DEMAND” were removed from all newly issued notes. Five years later, the redemption of paper notes for gold and silver ended.

The words hinting on the origins and the idea behind paper money were removed. The golden color disappeared. All that was left was the paper and with it the ability of the government to print as much of it as it wishes.

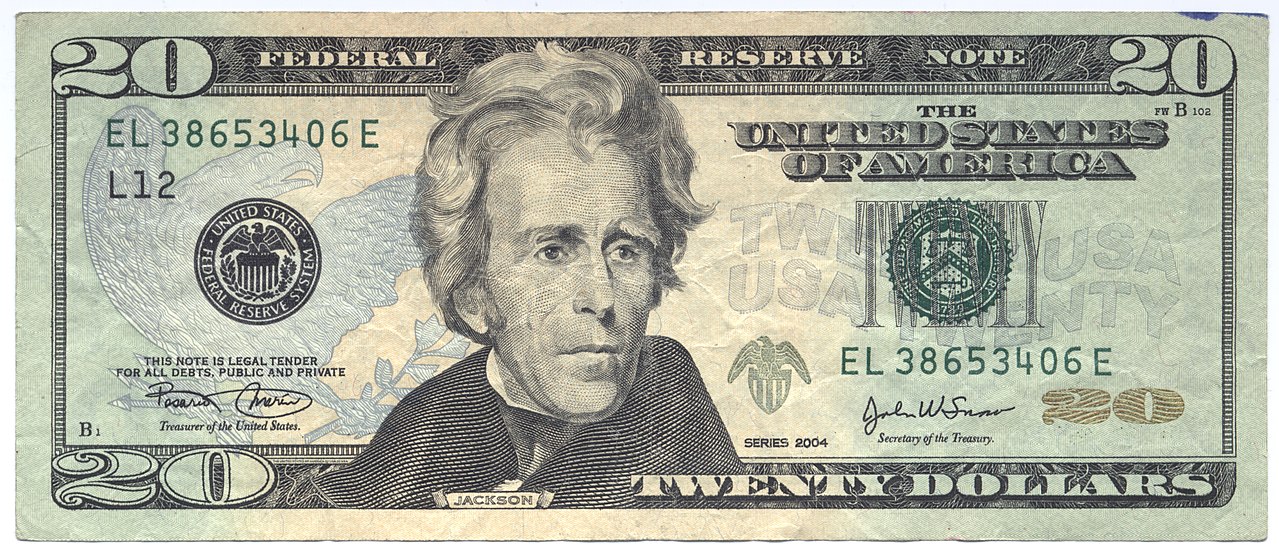

With the abolishment of the gold standard in 1971, this century-long sleight-of-hand was complete. Money became the illusion we all share to this day: fiat money. It is worth something because someone commanding an army and operating jails says it is worth something. As can be clearly read on every dollar note in circulation today, “THIS NOTE IS LEGAL TENDER”. In other words: It is valuable because the note says so.

By the way, there is another interesting lesson on today’s bank notes, hidden in plain sight. The second line reads that this is legal tender “FOR ALL DEBTS, PUBLIC AND PRIVATE”. What might be obvious to economists was surprising to me: All money is debt. My head is still hurting because of it, and I will leave the exploration of the relation of money and debt as an exercise to the reader.

As we have seen, gold and silver were used as money for millennia. Over time, coins made from gold and silver were replaced by paper. Paper slowly became accepted as payment. This acceptance created an illusion — the illusion that the paper itself has value. The final move was to completely sever the link between the representation and the actual: abolishing the gold standard and convincing everyone that the paper in itself is precious.

Bitcoin taught me about the history of money and the greatest sleight of hand in the history of economics: fiat currency.

Down the Rabbit Hole

- Enders Game by Parker Lewis

- Bitcoin Fixes This by Parker Lewis

- Bitcoin Obsoletes All Other Money by Parker Lewis

- Bitcoin Is a Rally Cry by Parker Lewis

- Bimetallism by Wikipedia Contributors

- Methods of Coin Debasement by Wikipedia Contributors

- Thaler by Wikipedia Contributors

- U.S. Silver Certificate by Wikipedia Contributors

- 📚 How Is Fiat Money Possible by Hans-Hermann Hoppe

- 📚 On The Origins Of Money by Carl Menger